Baykanber Insights

Your go-to source for the latest news and trends.

Marketplace Liquidity Models That Dance to Supply and Demand's Rhythm

Discover how marketplace liquidity models adapt to supply and demand dynamics. Uncover secrets that drive successful trading today!

Understanding the Balance: How Marketplace Liquidity Models Respond to Supply and Demand

In the world of marketplaces, understanding the balance between supply and demand is crucial for ensuring liquidity. Liquidity refers to how easily assets can be bought or sold in the market without causing drastic price changes. When supply exceeds demand, liquidity tends to increase as sellers compete to attract buyers, often leading to a reduction in prices. Conversely, when demand outstrips supply, liquidity decreases, creating a more competitive environment where buyers may be willing to pay higher prices. This dynamic interplay between supply and demand is critical for maintaining a healthy marketplace.

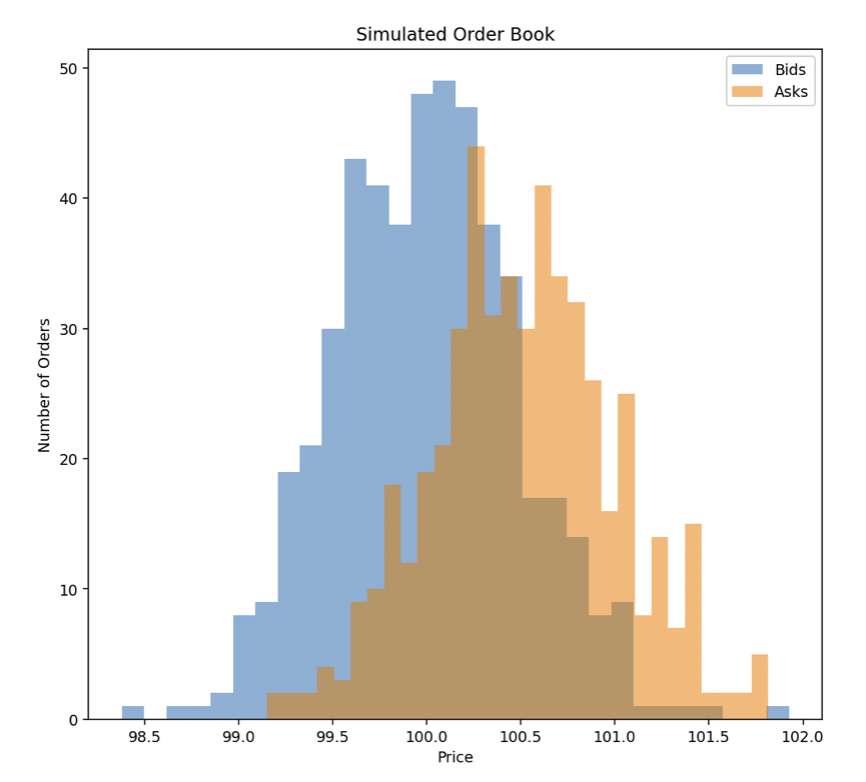

Several models can illustrate how marketplace liquidity responds to shifts in supply and demand. For instance, the Order Book Model showcases how orders are placed by buyers and sellers, creating a transparent view of market liquidity. Additionally, the Market Maker Model facilitates transactions by providing liquidity through continuous bid-ask spreads, thus stabilizing price movements. Understanding these models enables businesses and investors to navigate the marketplace effectively, maximizing opportunities while mitigating risks.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players can choose between two teams: Terrorists and Counter-Terrorists, each with distinct objectives. For those looking to enhance their gaming experience, using a daddyskins promo code can provide valuable in-game items and skins.

The Impact of Supply and Demand on Marketplace Liquidity: Key Insights

The relationship between supply and demand is fundamental in determining the liquidity of a marketplace. When the demand for a product or service exceeds its supply, prices tend to rise, leading to increased market activity as sellers seek to capitalize on the higher price points. Conversely, when supply surpasses demand, prices typically fall, which can result in decreased market participation and lower liquidity. Understanding this dynamic is crucial for investors, traders, and businesses aiming to navigate fluctuating market conditions effectively.

Moreover, marketplace liquidity is influenced by various external factors such as economic conditions, consumer behavior, and technological advancements. For example, in a thriving economy where consumer confidence is high, both supply and demand can be robust, enhancing liquidity. In contrast, during economic downturns, reduced demand can lead to an oversupply of goods, causing price instability and lower liquidity. Therefore, staying informed about these factors is essential for anyone looking to optimize their strategies in the marketplace.

What Are The Best Practices for Optimizing Marketplace Liquidity Based on Supply and Demand?

Optimizing marketplace liquidity is crucial for maintaining a healthy balance between supply and demand. One of the best practices is to continuously analyze market trends to adjust pricing strategies accordingly. Employing tools such as demand forecasting and competitive analysis can help identify shifts in consumer behavior. Additionally, creating a transparent feedback loop where users can provide input on their experiences fosters trust and encourages more transactions, enhancing liquidity in the marketplace.

Another effective tactic is to implement dynamic inventory management. Utilizing real-time data to monitor supply levels allows marketplace operators to react swiftly to fluctuations in demand. Establishing partnerships with suppliers can also ensure that inventory remains well-stocked to meet consumer needs without overcommitting resources. Lastly, incentives such as reduced fees for high-volume sellers can encourage more transactions, benefiting overall marketplace liquidity.