Baykanber Insights

Your go-to source for the latest news and trends.

Liquid Gold: Navigating the Waves of Marketplace Liquidity Models

Dive into the secrets of marketplace liquidity models and discover how to turn your investments into liquid gold!

Understanding the Basics of Marketplace Liquidity Models

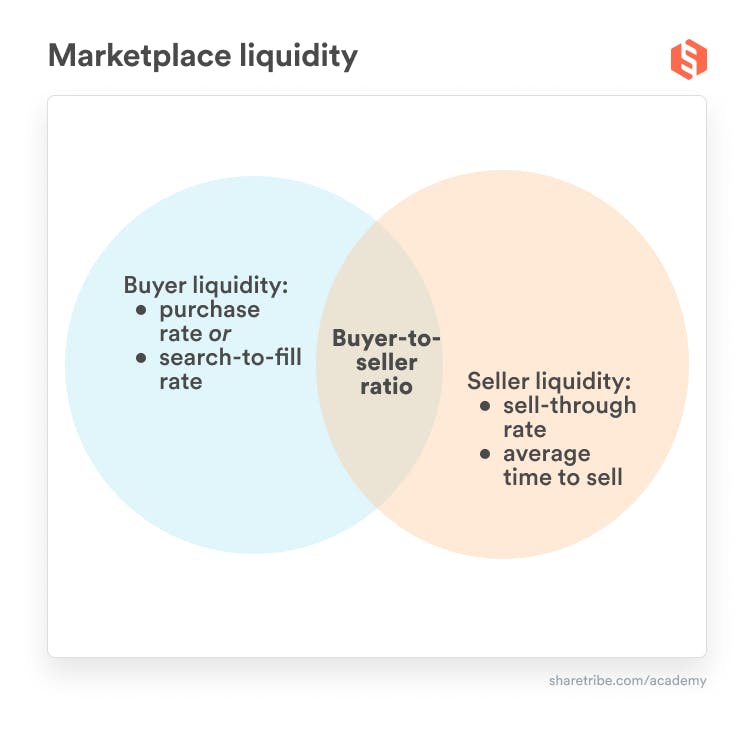

In the world of online marketplaces, liquidity models play a crucial role in determining how effectively buyers and sellers interact. At its core, marketplace liquidity refers to the ease with which assets or products can be bought and sold without causing significant price changes. Understanding the basics of these models is essential for entrepreneurs and businesses aiming to optimize their platforms. The two primary types of liquidity models are order-driven and quote-driven systems, each catering to different market dynamics and customer needs.

Order-driven markets focus on matching buy and sell orders directly, which promotes a transparent pricing environment. In contrast, quote-driven models rely on market makers to provide liquidity, ensuring that there are always willing buyers and sellers. To enhance liquidity and encourage participation, platforms often implement strategies such as dynamic pricing, incentivization for early adopters, and effective marketing to draw in users. By grasping these foundational concepts of marketplace liquidity models, stakeholders can make informed decisions to improve user experience and drive sales.

Counter-Strike is a popular tactical first-person shooter that focuses on team play and strategy. Players can choose to be either terrorists or counter-terrorists, working together to complete objectives. For those looking to enhance their gaming experience, a daddyskins promo code can provide access to exciting skins and items.

How to Optimize Your Marketplace for Maximum Liquidity

To optimize your marketplace for maximum liquidity, it is essential to focus on user experience and streamline transactions. First, ensure that your platform is intuitive and easy to navigate. Users should be able to find what they are looking for without frustration. Incorporating features like real-time search filters and personalized recommendations can significantly enhance user engagement. Additionally, optimizing loading speed is critical; faster websites not only improve user satisfaction but also reduce abandonment rates, thus driving higher liquidity.

Another key aspect to consider is payment flexibility. Provide various payment options to cater to different customer preferences. This includes traditional methods like credit cards and newer technologies like digital wallets or cryptocurrencies. Furthermore, incorporating dynamic pricing strategies can help to adjust offers based on demand, ensuring your marketplace remains competitive. Finally, fostering a sense of community among users can also promote higher liquidity; implementing features such as user reviews, ratings, and forums can encourage repeat transactions and enhance trust in your marketplace.

What Are the Key Factors Influencing Liquidity in Online Marketplaces?

Liquidity in online marketplaces is a critical aspect that impacts the efficiency and performance of digital transactions. Several factors contribute to the level of liquidity, including market structure, the type of goods or services offered, and the number of participants in the marketplace. A well-structured marketplace, which incorporates user-friendly interfaces and streamlined transaction processes, tends to attract more buyers and sellers, enhancing liquidity. Moreover, the nature of the products being sold is essential; for instance, commodities that are universally recognized and sought after are likely to experience higher liquidity compared to niche items.

Another significant factor influencing liquidity is the presence of effective marketing strategies and promotional campaigns. Marketplaces that invest in creating awareness and driving traffic through targeted advertising are more likely to see increased user engagement, leading to a vibrant trading environment. Furthermore, trust plays a pivotal role in liquidity; platforms that implement secure payment methods and transparent review systems are more likely to gain user confidence, thus attracting more buyers and sellers. In summary, the key factors influencing liquidity in online marketplaces revolve around market structure, product types, marketing efforts, and trust-building mechanisms.